City staff say debt level below limit amid investments, maintaining infrastructure

Niagara Falls city council continues to balance budget pressures against investment and maintaining current assets.

The city's Manager of Capital Accounting James Dowling told city council Tuesday night it's about stretching the dollar during a time when costs continue to go up.

"We're seeing in a lot of areas fleet, especially being impacted by quite long lead times. Some of our heavy equipment we're looking at 12 to 18 months from the time of ordering to delivery. So we're carrying our aging equipment longer before replacement," he says.

City staff say they aren't too worried about the 8.6% debt for Niagara Falls, when the limit is 15%. They add Niagara Falls' debt is comparable to other cities.

Dowling also pointed to investments in roads, sidewalks and sewers, but he added there are green initiatives too. "We're starting to look more at electric technology. We're looking at buying an electric zamboni, an electric sidewalk sweeper, we're going to be installing electric vehicle charging stations."

City staff add there will be a 0.54% increase to the operating budget for 2023.

Gas Prices to Hold Steady: Analyst

Gas Prices to Hold Steady: Analyst

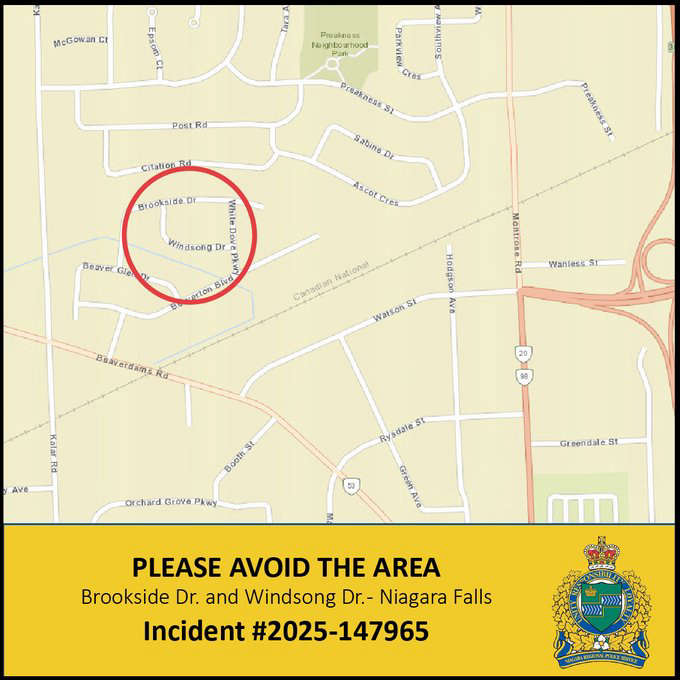

NRP Using Warrant in Niagara Falls Area

NRP Using Warrant in Niagara Falls Area

Part of Welland Canal Officially Named

Part of Welland Canal Officially Named

Girl Assaulted in Break and Enter

Girl Assaulted in Break and Enter

Invest in Officer Well-Being: Former Chair

Invest in Officer Well-Being: Former Chair

Niagara Companies Heavily Invest in Growth

Niagara Companies Heavily Invest in Growth

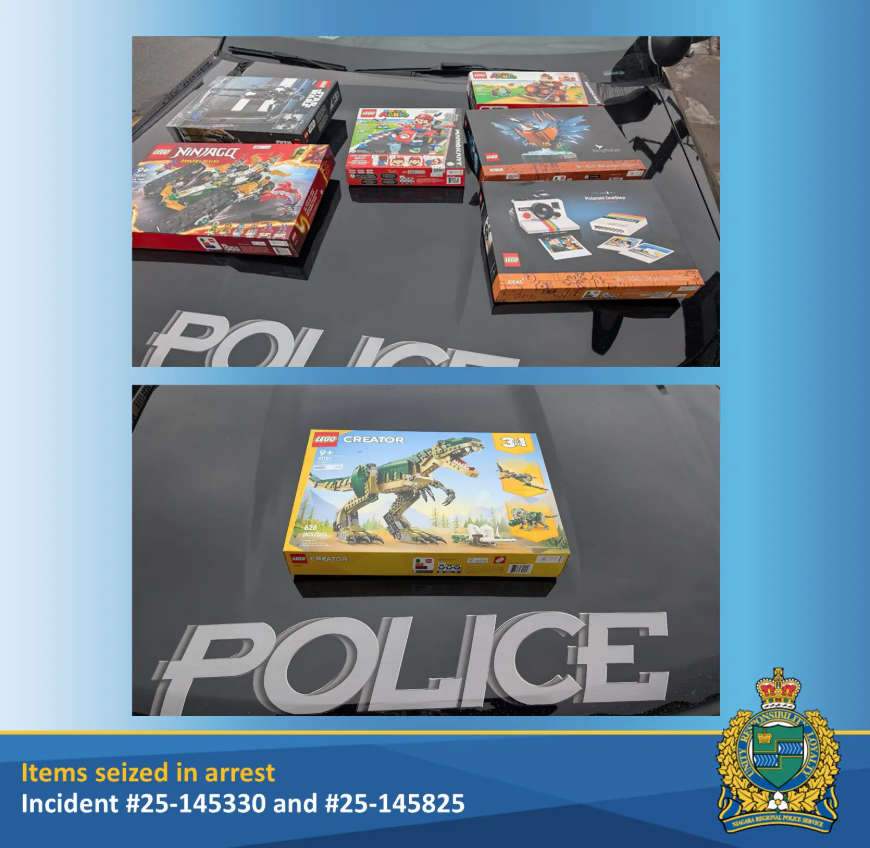

Man Arrested for Clifton Hill Shoplifting

Man Arrested for Clifton Hill Shoplifting

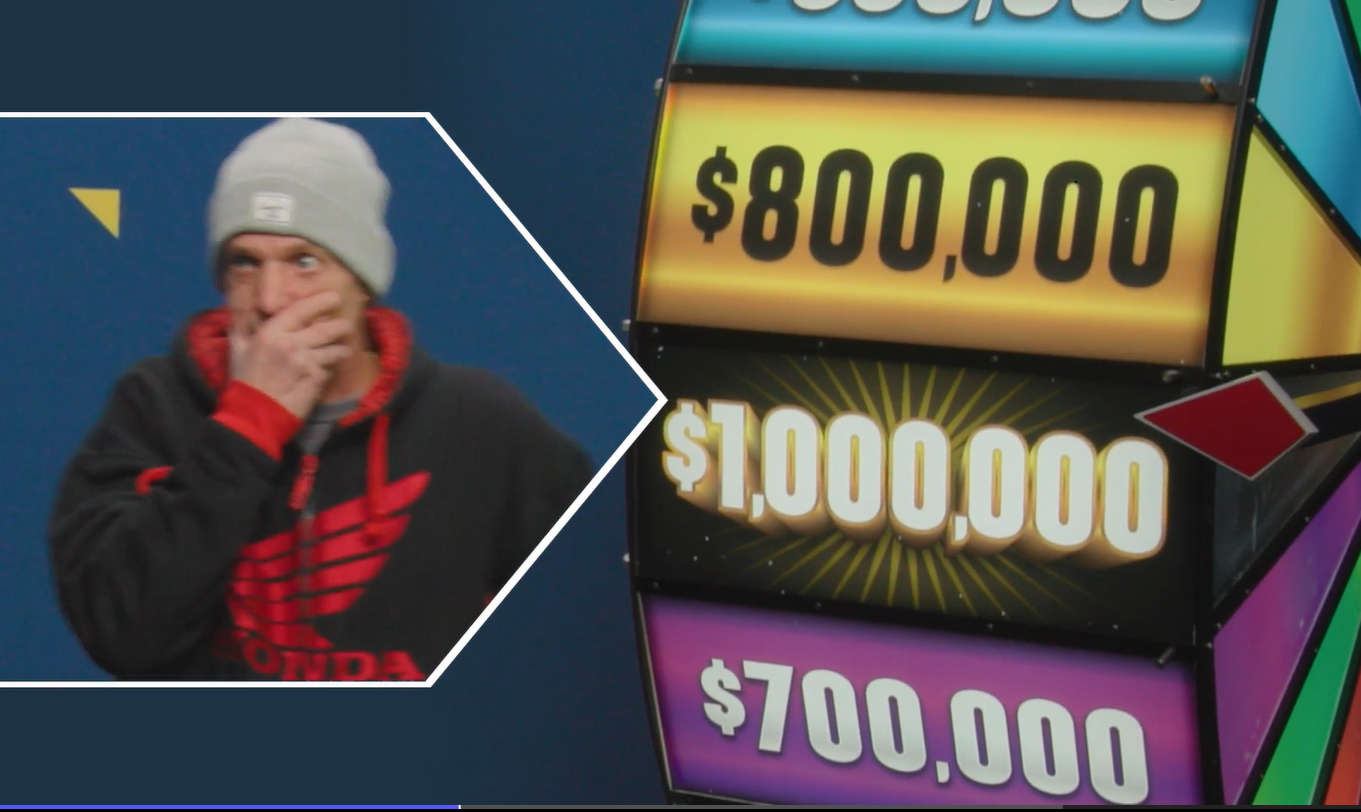

Fort Erie Man Wins Big Prize on Bigger Spin

Fort Erie Man Wins Big Prize on Bigger Spin